Top 7 Reasons Your Medical Practice Is Losing Revenue — And How to Fix It

Introduction

In today’s healthcare landscape, running a profitable medical practice is more challenging than ever. Rising operating costs, payer complexities, staff shortages, and administrative inefficiencies all impact cash flow. But the surprising truth is this: most revenue loss inside U.S. medical practices is preventable.

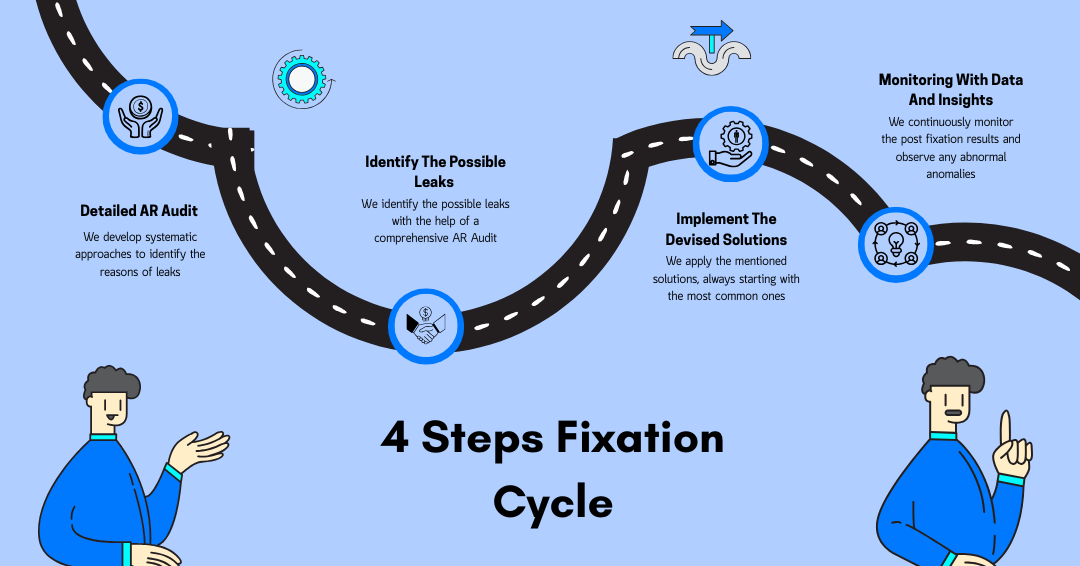

At A2Z Medical Solutions, after analyzing tens of practices across primary care, family medicine, behavioral health, cardiology, orthopedics, and internal medicine. We are able to crack the code by breaking down a bigger problem into smaller achievable milestones backed by a structured reason identification and fixation cycle to minimize revenue leaks.

1. High Denial Rates Due to Preventable Errors

Denials are the silent killers of a practice’s revenue. Nearly 65% of denials are never resubmitted. The most common preventable reasons include:

-

Missing or incorrect patient information

-

Eligibility errors

-

Incorrect modifiers

-

Outdated codes

-

Missing documentation

Solution:

Implement a front-end audit workflow + ensure every claim passes a multi-point check before submission. A2Z clients typically see a 40% reduction in denials within 90 days using this method.

2. Poor Eligibility & Benefits Verification

More than 25% of denials come from issues with eligibility. Staff are often overworked or rely on manual checking, which increases errors.

Solution:

Use automated E&B verification + dedicated verification specialists. This alone can increase monthly revenue by 10–15%.

3. Slow or Incorrect Charge Entry

Delayed charge entry = delayed cash flow. If charges are entered days late, the entire RCM cycle slows down.

Solution:

Adopt a 24–48 hour charge-entry turnaround with error validation and specialty-specific coding support.

4. Underpayment by Insurance Companies

Many practices don’t realize they are being underpaid. Payers often reduce reimbursements quietly unless you track fee schedules, allowed amounts, and historical payments.

Solution:

Use an automated underpayment detection system that flags payer discrepancies. Perform frequent fee schedule analysis. A2Z clients recover thousands every month just from underpayment corrections.

5. Lack of Clean Claim Process

A “clean claim” is one that gets accepted on the first submission. The industry benchmark is 95%, yet most practices sit between 75–85%.

Solution:

Strengthen documentation, coding accuracy, and front-end checks. Every 1% improvement in clean claim rate increases cash flow.

6. High AR Days (Aging >90–120)

Aging AR is the strongest indicator of cash-flow problems. Anything above 35–45 days means money is stuck.

Solution:

Implement structured AR workflows:

-

0–30 days: Standard follow-up

-

30–60 days: Aggressive follow-ups

-

60–90 days: Correct & resubmit

-

90+: Appeals + payer escalation

At A2Z Medical Solutions, we tend to reduce AR days from 120+ to under 45 within 8–12 weeks.

7. Inefficient In-House Billing Teams

In-house teams are often understaffed, untrained, or overwhelmed. Billing roles require specialization — coding, AR, E&B, payment posting — but most clinics hire 1–2 people for everything.

Solution:

Outsource to a specialized RCM partner who manages the entire workflow end-to-end.

Conclusion

Revenue loss is not inevitable. With the right RCM systems, automation, audits, and oversight, practices can reclaim thousands of dollars each month.